Welcome to our market review for September, where we recap the biggest developments in the past month, provide some snapshots of the cryptocurrency markets and assess different decentralized stablecoins in light of the recent draft legislation in the US.

Overview

-

News Recap

-

Markets Snapshot

-

Stablecoins Under the Spotlight

-

Upcoming Events

News Recap

-

Federal Reserve Raises Rates by 75 Basis Points at September Meeting

- The Fed continues to take a hawkish stance and raised the federal funds rate by 75 basis points on September 21st, which has weighed on risk assets like BTC and ETH. They increased the forecasts for the base interest rate from 3.4% at the end of the year to 4.4%, and from 3.8% at the end of 2023 to 4.6%.

-

Chainlink Announces Launch of Staking in December at SmartCon 2022

- Chainlink co-founder Sergey Nazarov announced at SmartCon 2022 that the highly anticipated staking program for LINK is due to launch in December. Nazarov also shed light on Chainlik’s collaboration with the global payments system SWIFT to explore utilizing Chainlink’s Cross-Chain Interoperability Protocol for transferring tokens and messages across multiple chains.

-

The Merge Occurs Without a Hitch, Although ETH is not Ultrasound Yet

- The Merge was successful on September 15th, transitioning Ethereum from Proof of Work to Proof of Stake. However, according to ultrasound.money, a website that tracks the supply growth of ETH, the number of tokens in circulation has actually increased slightly. Because of the low demand right now for Ethereum transactions, smaller amounts of ETH have been burned and the second largest crypto by market cap has remained slightly inflationary.

-

Ribbon Finance Launches on Custom Built Optimistic Rollup Aevo

- The beta version of Ribbon’s new order-book based DEX for options will be launched in October, with public mainnet following by the end of the year. Learn more about Aevo in this introductory blog post.

-

US Legislation Draft Proposes a Ban on Algo Stablecoins for 2 Years

- A draft bill, The House Stablecoin Bill, proposes placing a two-year ban on “endogenously collateralized stablecoins”, the first piece of legislation aimed at the stablecoin market. If successful, the bill would make it illegal to issue or create stablecoins that fall under this definition.

-

CFTC Files Lawsuit Against Decentralized Autonomous Organization

- The CFTC sued the decentralized autonomous organization Ooki DAO for running an unregistered futures exchange. Since 2021, Ooki DAO has governed the bZx protocol, which itself was fined $250,000 and settled with the CFTC. More details on the implications for other DAOs are outlined here.

-

Cosmos Poised to Revamp ATOM Tokenomics

- On September 26th, Cosmos released a whitepaper detailing the new tokenomics for ATOM, which includes reducing issuance for the next three years.

-

BNB Chain Governance to Decide What Will Happen to Hacked Funds

- On October 6th, a hacker seized $560 million in BNB from the BSC Token Hub, transferring more than $100 million to other chains. The hacker exploited a security bug to fake security proofs that are required to withdraw the bridge’s locked funds. In an October 7th update, the BNB Chain team stated that there will be an on-chain governance vote to determine whether the hacked funds will be frozen.

-

Optimism and Galxe launch Optimism Quests

- Optimism users can earn NFTs for completing simple tasks for 18 different protocols in the ecosystem. Although unconfirmed, the NFTs may play a role in the next OP token airdrop. Following the launch of Optimism quests, the L2 scaling solution experienced a massive uptick in the number of daily active users. Also, September saw the highest number of transactions in a month so far in Optimism’s history at 5.1 million.

Markets Snapshot

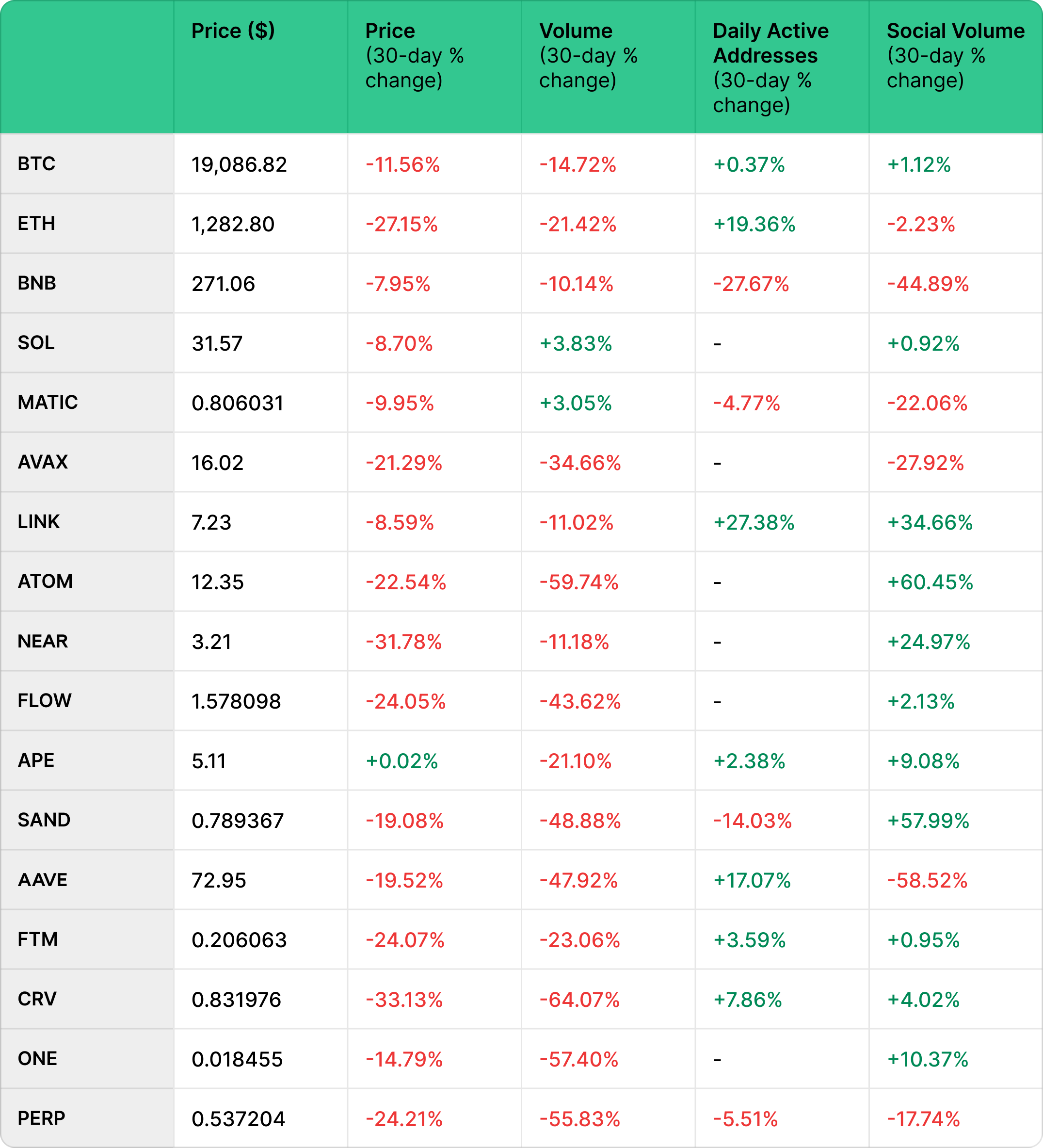

The snapshot for markets on Perp v2 over September 11th to October 11th is displayed below:

Source: https://app.santiment.net/s/4N6KAI95 as of October 11th (08:00 UTC). Active addresses data unavailable for those with “-”.

-

All markets are in the red over the past 30 days apart from APE (+0.02%), with the steepest declines seen for NEAR (-31.78%), CRV (-33.13%) and ETH (-27.15%). The markets with the smallest losses were LINK (-8.59%) and BNB (-7.95%).

-

A similar pattern is seen for trading volumes, which are all down versus 30 days ago. The largest decline in trading volumes was seen for CRV (-64.07%), ATOM (-59.74%) and PERP (-55.83%).

-

Despite the downturn in valuations, LINK, ETH and AAVE have posted strong growth in the number of active addresses, increasing 27.38%, 19.36% and 17.07% respectively. BNB and SAND saw the largest drops in the active addresses, falling 27.67% and 14.03% respectively.

-

Social volume was up for most markets, with the biggest gainers being ATOM (+60.45%), SAND (+57.99%) and LINK (+34.66%). The coins with the steepest declines in social volume were AAVE (-58.52%), BNB (-44.89%) and AVAX (-27.92%).

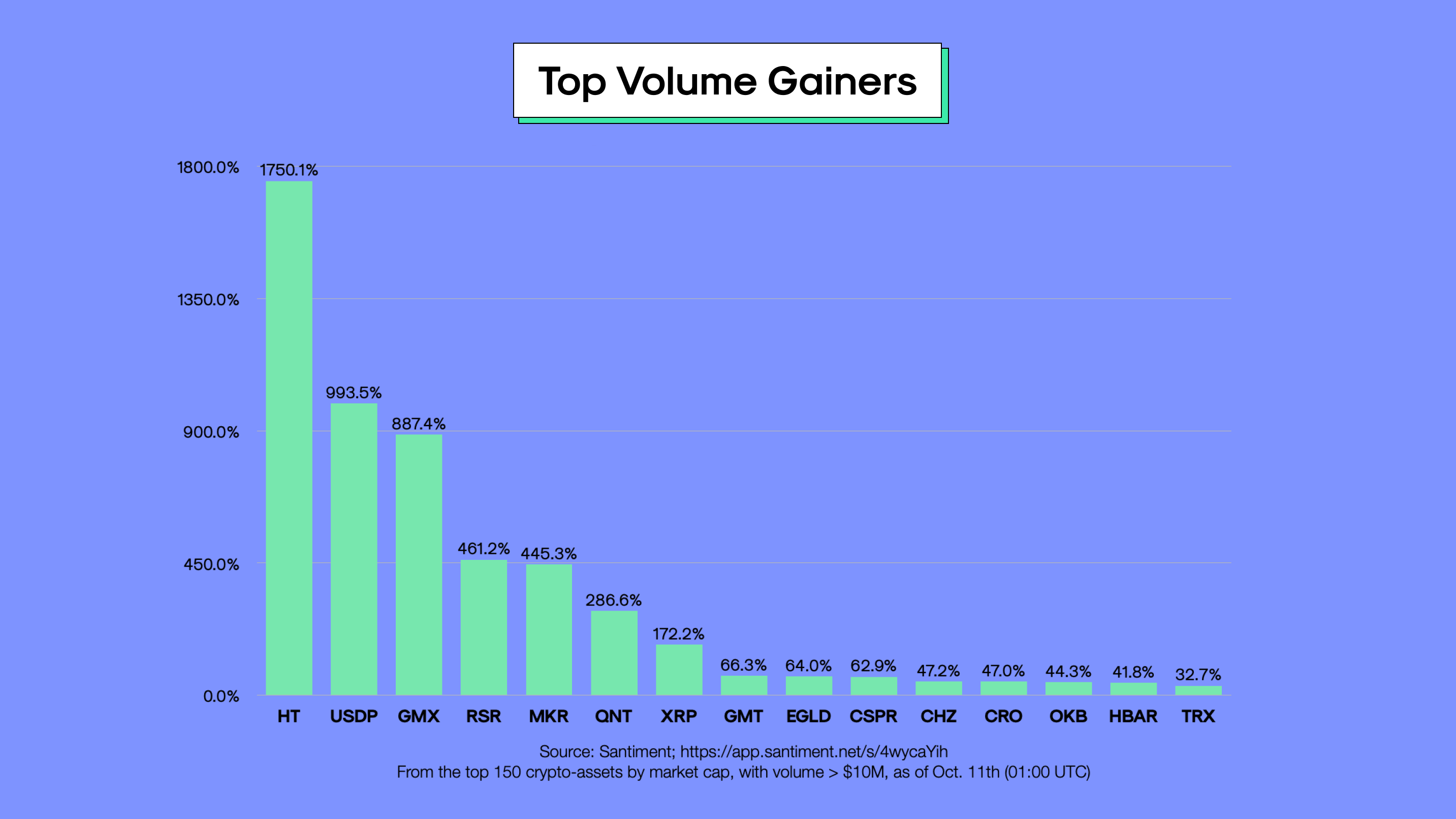

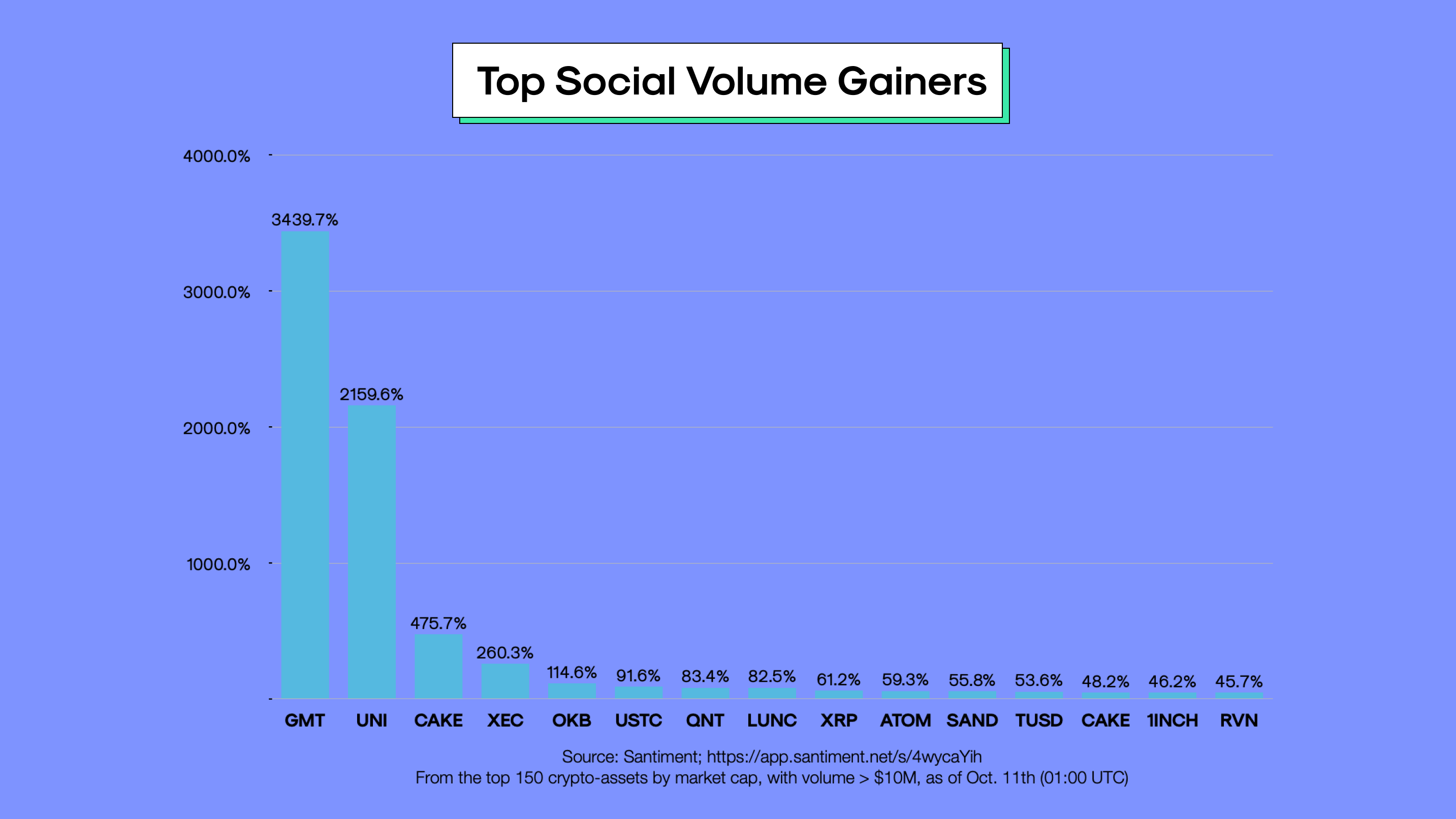

Looking at the wider market, the top 15 crypto-assets by volume growth and social volume growth between September 11th and October 11th are both shown below:

Source: Santiment; https://app.santiment.net/s/4wycaYih

-

HT, USDP and GMX were the top volume gainers in the past 30 days for the top 150 crypto-assets by market capitalization. GMX benefitted from listings on two of the largest centralized exchanges: Binance and FTX.

-

RSR saw a 461.2% gain in trading volume, with hype around the October 10th mainnet launch at Devcon 6.

-

MKR is another top performer when it comes to volume growth, with a 445.3% gain.

-

QNT and XRP are also notable outperformers, with trading volume rising 286.6% and 172.2% respectively.

Source: Santiment; https://app.santiment.net/s/4wycaYih

-

Stepn’s GMT token saw the largest gain in social volume over the past 30 days, recording a 3,439.7% rise.

-

UNI experienced strong growth in social volume, with a 2,159.6% gain as Uniswap Labs was reportedly in talks to raise $100 million in funding.

-

CAKE also saw strong growth with an increase of 475.7% in social mentions.

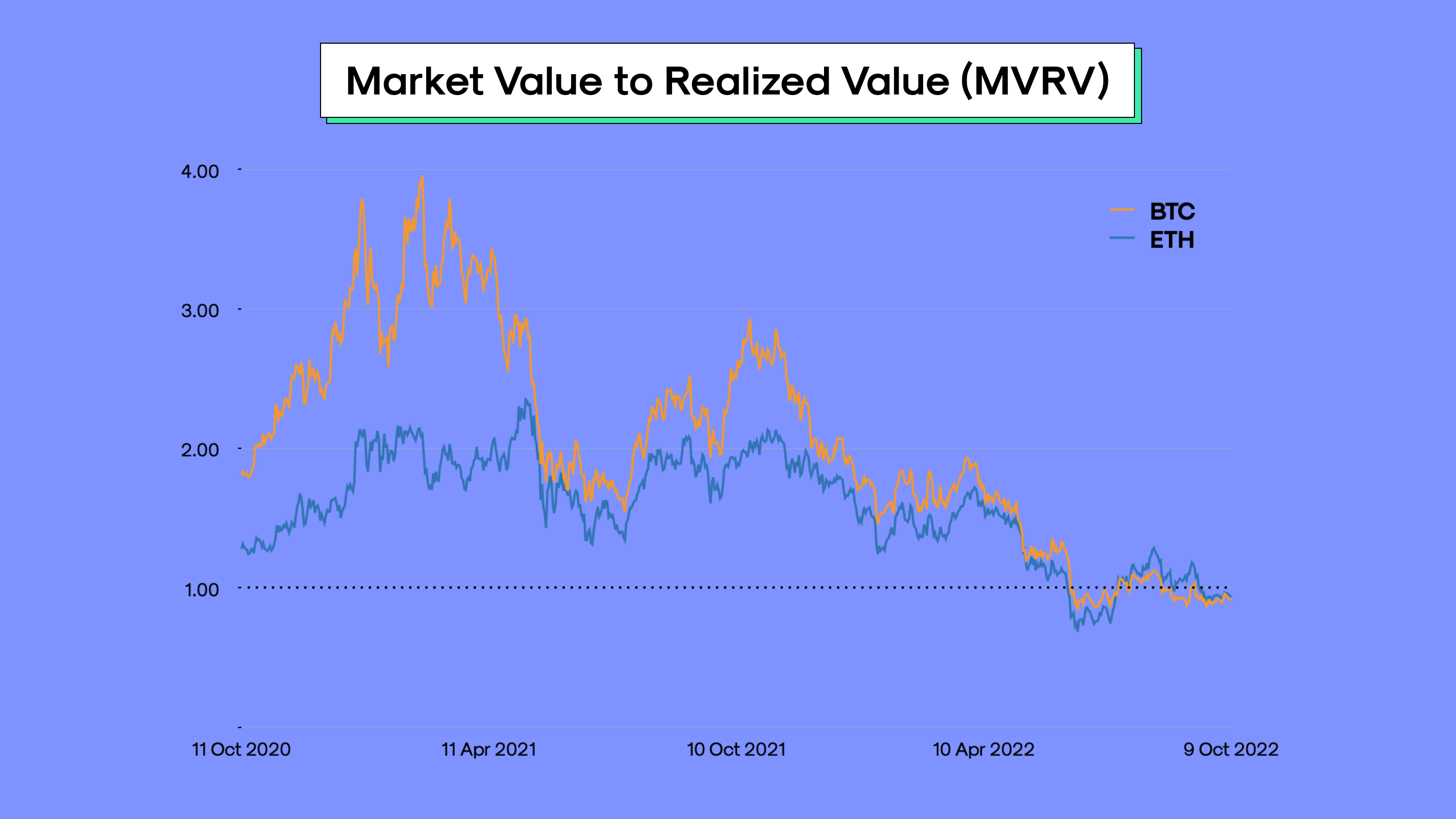

Source: CoinMetrics

The MVRV for both Bitcoin and Ethereum hit lows below one on September 21st before rebounding. However, this metric is still below one at the time of writing, suggesting a bottom is yet to be found and that a potential test of the year’s low for BTC and ETH are on the cards. We’d want to see the MVRV move above one and out of the buy zone for confirmation that a long-term bottom is in, otherwise a test of the lows at $17,560 and $880 for BTC and ETH is likely.

Stablecoins Under the Spotlight

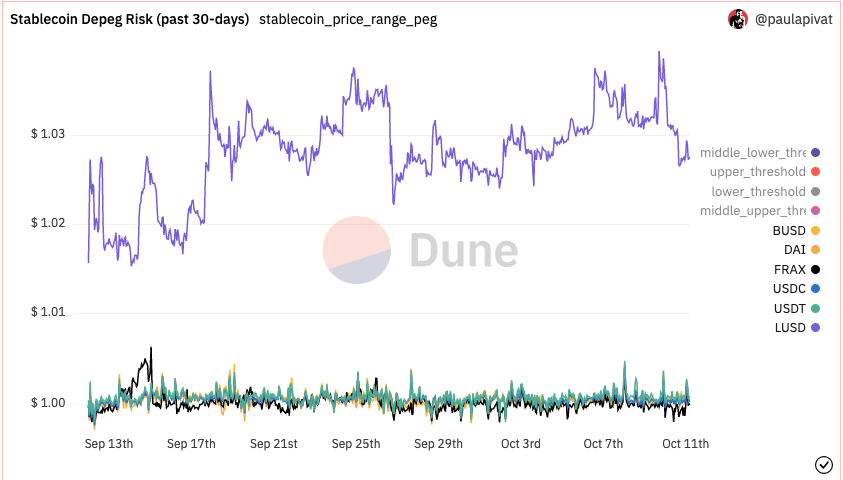

From the recent draft stablecoin bill, to the Tornado Cash sanctions fallout and the recent plans from MakerDAO to freely float DAI and move away completely from being pegged to the dollar, focus has shifted to the domain of decentralized stablecoins.

Despite all the bumps along the road in recent months, with liquidations stemming from collapses in CeFi such as Celsius and the aftermath of 3AC getting REKT, decentralized finance (and decentralized stables in particular) held up spectacularly well. In what follows, we’ll summarize four of the most promising stables that every DeFi user should know about:

-

Frax Finance’s FRAX

-

Liquity’s LUSD

-

Alchemix’s alUSD

-

Qi Dao’s MAI

Frax Finance: FRAX

-

Stablecoin rank: #5

-

Market cap: $1.36 billion

-

Chains: 18 chains, mainly Ethereum

FRAX is a decentralized stablecoin that launched in December 2020, becoming the most popular alternative to centralized stablecoins like USDC and USDT, as well as the second largest crypto-backed stable after MakerDAO’s DAI. Frax Finance also developed the first non-nation state pegged stablecoin (FPI) which accounts for inflation according to the US consumer price Index.

The hybrid design of FRAX means that it benefits from being partially collateralized (92%) and partially algorithmically stabilized, achieving decentralization, capital efficiency AND a stable peg all at the same time. FRAX boasts the lowest peg deviation out of any stablecoin over the past nine months (0.25%) and the deepest liquidity out of any stablecoin’s 3Pool on Curve.

To mint FRAX, some USDC is required to be put up as collateral, as well as the protocol’s governance token FXS. For example, to mint $100 of FRAX, you’d need to deposit $92 in USDC and $8 of FXS. The FXS is burned to mint FRAX and when the user wants to redeem their tokens, they must burn $100 of FRAX. They’ll receive the USDC back that was stored as collateral, while $8 worth of FXS will be minted and returned to the user.

A veTokenomic model is utilized for FXS, where veFXS holders obtain voting power to direct FXS emissions across different pools on DEXes to facilitate liquidity for FRAX, as well as rewards from fees, the protocol’s revenue and collateral value.

While the price of FXS dropped on the news of the draft stablecoin bill in the states, FRAX could easily revamp itself to have a 100% collateral ratio and still be more capital efficient than others with higher ratios. In fact, Frax’s ambition is to be the most diverse on-chain stablecoins to exist. Already it has built a thriving ecosystem around its stablecoin, becoming the first DeFi protocol to offer stablecoins, liquidity and lending services with FRAX, FraxSwap AMM and FraxLend. The vision is that Fraxlend loans and even yield from the upcoming fxsETH staking derivative will complement the existing model and the backing behind FRAX more diverse.

Dive deeper into FRAX here.

Liquity: LUSD

-

Stablecoin rank: #14

-

Market cap: $175.6 million

-

Chains: 6 chains, mainly Ethereum (~90%) and Optimism (~10%)

Liquity USD (LUSD) is a decentralized stablecoin that is backed purely by ETH that is part of the Liquity lending protocol. While no interest is charged, there’s an initial 0.50% fee. The process looks something like this: deposit ETH, borrow LUSD and deposit LUSD into a stability pool, where depositors participate in liquidation, allowing you to buy ETH at a discount!

Liquity has a minimum collateral ratio of 110%, meaning you need to maintain a minimum of $110 in ETH for a LUSD loan of $100. If any borrowers fall below the 110% minimum collateral ratio, the ETH put up as collateral in the Trove will be liquidated and sold off. Anyone can liquidate a trove by calling a transaction and receive 200 LUSD, 0.5% of the ETH and LQTY rewards. This differs from MakerDAO's auction model, where Liquity’s approach results in instant liquidation.

There’s no governance and since there are no admin keys, it is entirely immutable. Also, there’s no official frontend. Instead, there are various third party frontend operators that are incentivized with a 1% share of the revenue they facilitate.

While not strictly fixed to $1, the ‘soft peg’ is part of LUSD’s design. That means the stablecoin can depeg, but it only depegs to the upside. In this case, when LUSD is above $1, it costs borrowers more than the face value of their loan to acquire LUSD to repay it. For trove owners to avoid liquidation when ETH is in a bear market, borrowers will have to buy LUSD, which acts to push the price above the $1 peg.

Source: Dune Analytics

Liquity released their chicken bonds on October 4th, where LUSD can be bonded in exchange for bLUSD (a staking derivative/LP token backed by the LUSD reserve). The proceeds from the chick bonds are put into the LUSD stability pool, the LUSD Curve pool, and Yearn Finance to generate an amplified yield. Users can either ‘chicken out’ to get LUSD back, minus any yield accrued since initiating the bond, or ‘chicken in’ to make bonding permanent.

Learn more about Liquity here.

Alchemix: alUSD

-

Stablecoin rank: #13

-

Market cap: $177 million

-

Chains: 4 chains, mainly Ethereum

Alchemix is a decentralized borrowing platform that was launched in March 2021 (and recently expanded to Optimism!) that allows investors to take out self-repaying loans by depositing ETH, DAI, or even yield-bearing versions of these two tokens.

The alUSD stablecoin, which is interchangeable with DAI at a 1:1 ratio through Alchemix’s transmuter, can be minted by depositing collateral. Since the minimum collateral ratio is 200%, you’d need $200 worth of ETH, DAI, or yield-bearing variants of these tokens to borrow up to $100 worth of alUSD.

Once a loan is taken out and the investor holds alUSD, the collateral they deposited is put into a yield generating protocol such as Yearn Finance, where the proceeds are used to pay off the loan automatically. Alchemix’s self-repaying feature means borrowers can gradually withdraw their collateral over time as the loan is paid off from the yield bit by bit and don’t face the risk of liquidation.

alUSD relies on arbitrage to keep the price pegged to the dollar. When alUSD trades below $1, investors are incentivized to buy the stable at a discount and repay their loans, where the buying pressure returns alUSD to the peg. When the price of alUSD is above $1, it encourages loans to be taken out, which can generate extra alUSD and can be sold on the market.

Check out Alchemix’s docs for more information about the protocol.

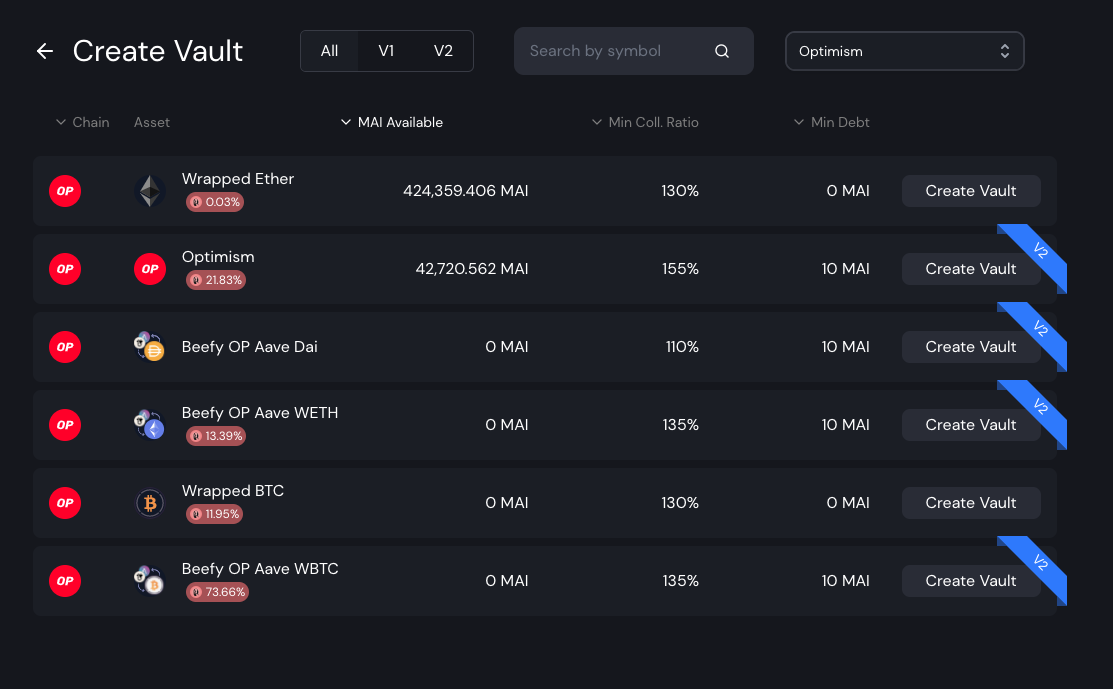

QiDao: MAI

-

Stablecoin rank: #27

-

Market cap: $53.4 million

-

Chains: 17 chains, mainly Polygon, Optimism and Fantom

QiDao is a collateralized debt position protocol like MakerDAO, where the MAI stablecoin is soft-pegged to the dollar and backed by 60 different assets, such as WBTC and ETH. As a result, the stablecoin isn’t reliant on centralized collateral like USDC.

The protocol enables users to lock a variety of different assets as collateral into a vault and borrow MAI without any interest fees. Borrowers only pay a fixed 0.50% fee when the loaned amount is repaid. With an overcollateralization ratio of 130%, there’s no risk of a death spiral as $130 worth of assets must be locked to mint up to $100 worth of MAI.

If the price of MAI drops too far below $1, anyone who borrowed or minted MAI will be incentivized to repay their debt, where some of the buy pressure from borrowers increases the price of MAI and helps to move the price back to $1.

One advantage of QiDao is that you can earn a yield on the borrowed amount of MAI for different collateral vaults, e.g., the OP or WETH vaults on Optimism, paid in the protocol’s governance token QI.

Like FRAX, QiDao also implements a veTokenomic model, where QI tokens can be locked into eQI on Polygon to earn weekly QI rewards, which come from a portion of the protocol’s revenue. Holding eQI also gives you voting power to decide on which of the boosted vaults to receive QI rewards.

Put your newly found knowledge into action by completing QiDao’s Optimism quest here!

Upcoming Events

-

October 11-14: Devcon 6

- The sixth Devcon, a major Ethereum conference, takes place in Bogota, Colombia.

-

October 12: FOMC minutes (18:00 UTC)

- The minutes from the September meeting will be published. Investors will be looking for clues about the policy outlook and may have an impact on markets depending on the content in the minutes.

-

October 13: US CPI report (12:30 UTC)

- The consumer inflation figures for September will be released and the consensus estimate for the year-on-year change is 6.5%, while for the month-on-month change, it is 0.5%. Larger than expected readings are likely to be bearish for risk assets, as higher inflation will increase the Fed’s appetite for further aggressive rate hikes.

-

October 17: Celsius asset auction

- The final bid deadline for Celsius’s asset auction will be October 17, according to a court filing. An auction will take place, if necessary, on October 20.

-

October 18: Avalanche’s Banff upgrade

- An upgrade which activates Elastic Subnets to unlock the ability for Subnet creators to activate Proof-of-Stake validation and uptime-based rewards using their own token on their own Subnet. For the first time, anyone can become a validator of a Subnet by simply staking its token on the P-Chain. Read more about the details here.

-

October 28: ZkSync 2.0 Mainnet Launch

- Matter Labs’ ZkSync 2.0, a zero-knowledge rollup scaling solution, is due to launch its mainnet on October 28th.

-

November 2: Fed Interest Rate Decision & Monetary Policy Statement (18:00 UTC)

- The Federal Reserve will release its latest interest rate decision and monetary policy statement. Expect high volatility around the time of this event.

-

November 2: FOMC Press Conference (18:30 UTC)

- A press conference will provide more insight into the Fed’s stance and policy outlook. Expect high volatility around the time of this event.

-

November 4: Non Farm Payrolls (12:30 UTC)

- The Non Farm Payrolls will be released, one of the key data points that the Fed considers when deciding monetary policy.

-

November 8: US midterm elections

- Equities have typically rallied following midterm elections in the US, which could provide a silver lining for crypto markets given that the two asset classes exhibit a strong, positive correlation.

-

November 10: US CPI report (12:30 UTC)

- The consumer inflation figures for October will be released. Larger than expected readings are likely to be bearish for risk assets, as higher inflation will increase the Fed’s appetite for further aggressive rate hikes.

We want to hear your feedback and also hear what future topics you’d like to see in our monthly report. Contact us via Discord or Twitter.

Disclaimer: the contents of this report should not be taken as financial advice and is provided purely as market commentary. The information provided in this report is not intended to form the basis for making investment decisions and is presented here for educational purposes only. Please do your own research before participating in the crypto market, seek independent advice on crypto-assets and ensure you are aware of the risks involved.