Welcome to our first market review, where we recap the biggest developments in the past month or so, provide some snapshots of the crypto markets and look ahead to Ethereum’s Merge.

Overview

-

News Recap

-

Markets Snapshot

-

The Merge is Looming

-

Upcoming Events

News Recap

-

-

The Fed raised interest rates by 75 basis points on July 27th, in line with market expectations.

-

The decision by the US central bank led to a relief rally across risk assets and reduced the probability of 100-basis-point hikes going forward.

-

-

Aave (AAVE) introduced plans for a stablecoin, called GHO

-

By the end of July, Aave governance passed the proposal for its new yield-generating stablecoin. Similar to DAI, users will be able to mint GHO tokens against supplied collateral assets.

-

Want to learn more about GHO? Aave founder Stani Kulechov breaks it all down for us in this episode of Bankless from EthCC. Stani stated that GHO is “the first stablecoin which is overcollateralized, but also at the same time you can earn yield on your collaterals that you are supplying into the Aave protocol.”

-

-

Tesla converted ~75% of its Bitcoin (BTC) to fiat, adding $936 million of cash to its balance sheet.

-

Ethereum (ETH) successful merges Sepolia testnet on July 6th

- The second testnet to activate Proof-of-Stake, Sepolia, successfully upgraded at block number 1,450,409.

-

Over 8,000 Solana (SOL) wallets compromised in multi-million dollar hack

- More than 8,000 wallets had been drained for $8 million worth of tokens in a hack exploiting Phantom, Slope and TrustWallet users.

-

Curve Finance (CRV) founder discussed possibility of an upcoming stablecoin

- Check out this interview with Curve founder Michael Egorov to learn more.

-

- Lido is planning to expand to Layer 2 and plans to support stETH “on all sufficiently proven Layer 2 networks with demonstrated economic activity, starting out with Arbitrum and Optimism”.

-

Polygon (MATIC) Launches zkEVM

- Polygon announced its first Layer 2 with EVM equivalence, using zero-knowledge rollups to make transacting cheaper than on Ethereum mainnet.

-

Fantom (FTM) community decides to use burn fee to fund ecosystem projects

- A governance vote passed with near 100% approval to divert a third of burn fees to fund ecosystem projects.

Markets Snapshot

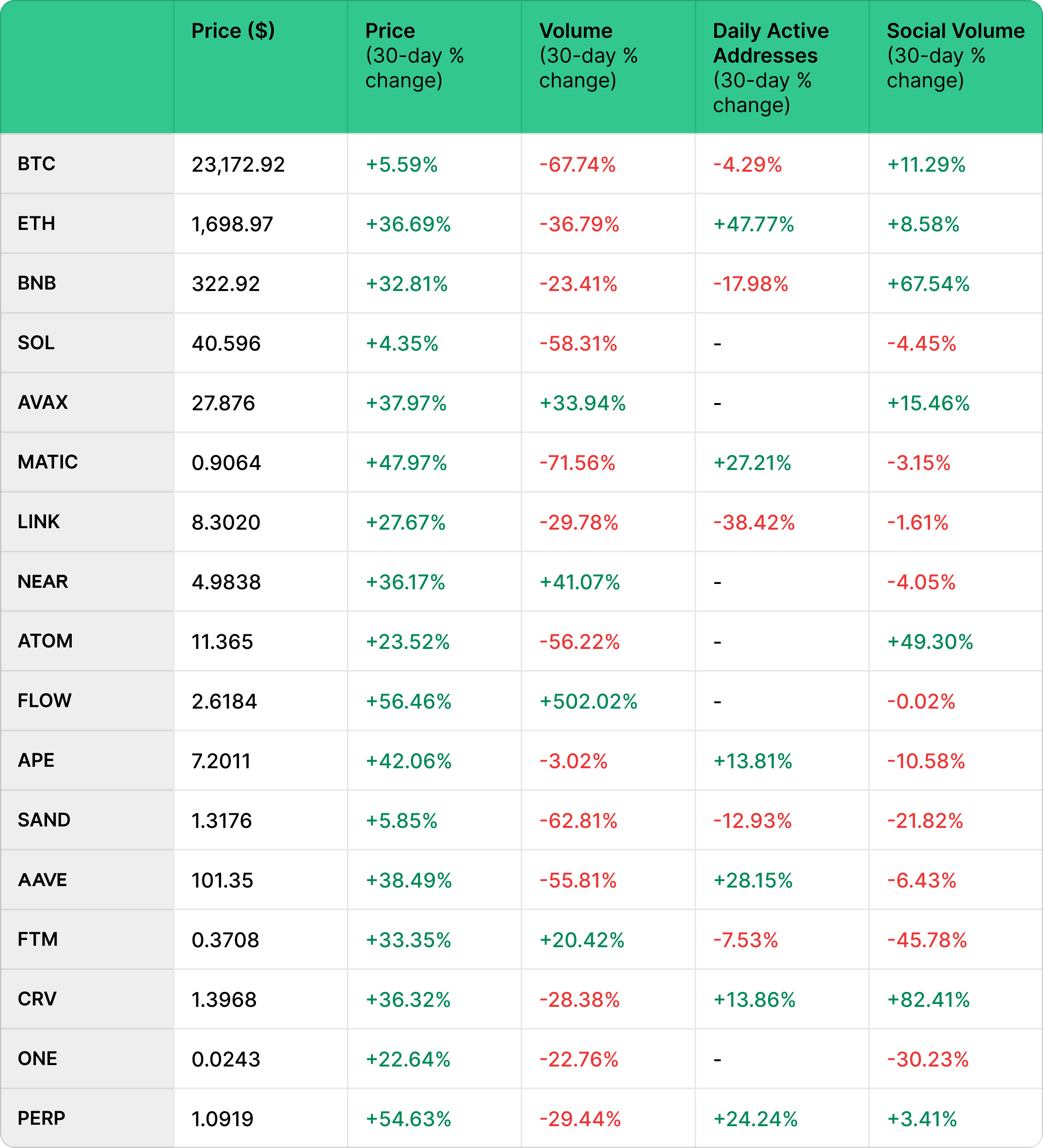

The snapshot for markets on Perp v2 over July 9th to August 8th is displayed below:

Source: Santiment; https://app.santiment.net/s/4N6KAI95. As of August 8th (00:00 UTC).

-

Experiencing the largest price increase over the past 30 days, FLOW is up over 50% (although still down -92.9% from ATH, much deeper and further away as compared to BTC or ETH). All other markets on Perp v2 saw increases in price over the 30 days.

-

Other strong performers were PERP (+54.63%), APE (+42.06%), and AAVE (+38.49%), while ETH and AVAX also saw strong gains. BTC and SAND were the weakest price performers, both gaining around +5%.

-

Along with a massive increase in price on the back of the news of the Instagram integration in early August, the market-wide trading volume for FLOW has risen more than +500% over the past 30 days. Other volume gainers are NEAR (+41.07%), AVAX (33.94%), and FTM (+20.42%). MATIC and SAND have seen the biggest drops in volume, -72% and -63% respectively.

-

For crypto-assets with active address data, ETH saw the strongest growth as the Merge date draws near, with active addresses growing more than 40%. AAVE and MATIC have also seen a large rise in active addresses, +27% and +28% respectively.

-

CRV saw the greatest gain in social volume, increasing 82.41% over the past 30 days. Social volume is defined by Santiment as the number of times there is at least one mention in their curated lists of Telegram chats, Twitter accounts and Reddit channels. BNB and ATOM also saw decent growth in social volume, +68% and +49% respectively.

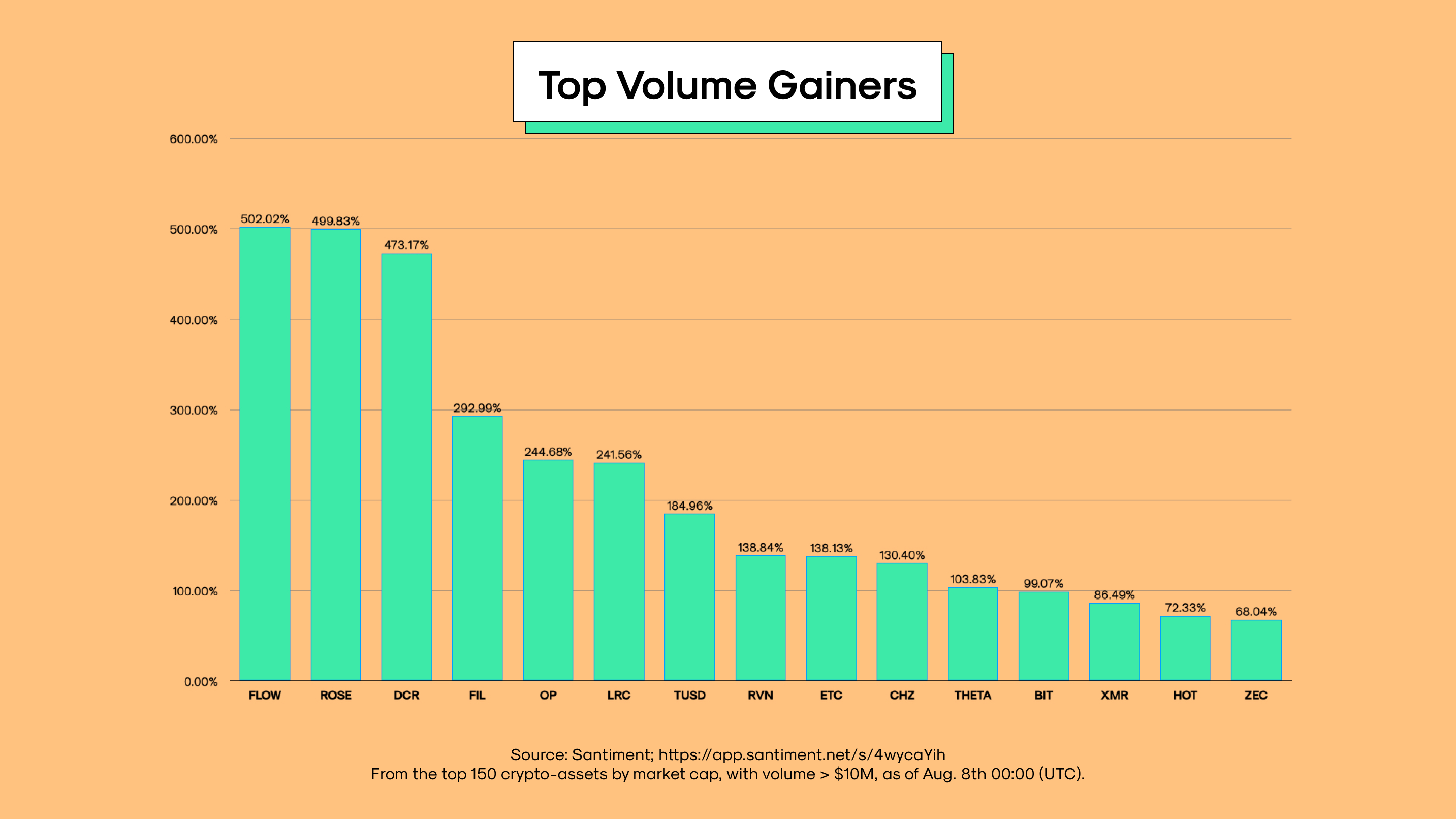

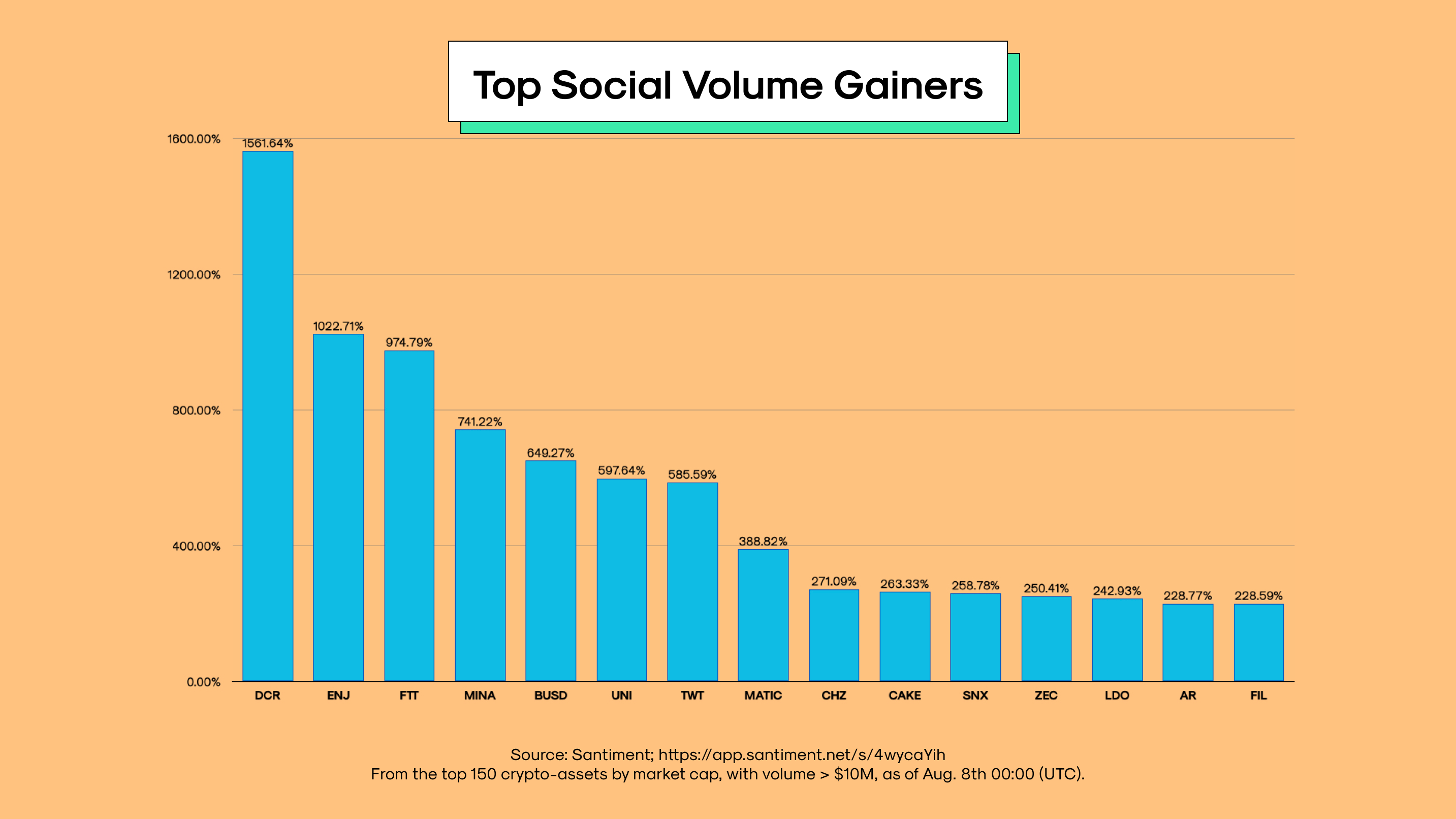

Looking at the wider market, the top 15 crypto-assets by volume growth and social volume growth between July 9th and August 8th are both shown below:

Source: Santiment; https://app.santiment.net/s/4wycaYih, as of August 8th (00:00 UTC).

-

FLOW saw a massive increase in volume over the past 30 days on the back of a partnership with Instagram and the social media app’s integration of FLOW NFTs.

-

OP saw a 244.68% rise in volume over the same period as OP Summer incentives went into play across different protocols and the token’s price rose to new highs on August 3rd.

-

ETC and RVN also saw a large increase in volume as the Merge approaches, with traders becoming more interested in the native assets of Proof-of-Work chains where Ethereum miners could redirect their hash power. Since mid-July, the price of ETC has risen more than 174%.

-

CHZ also saw an uptick in volume, as Chiliz acquired a 24.5% stake in Barcelona FC’s digital-content creation arm Barca Studios.

Source: Santiment; https://app.santiment.net/s/4wycaYih, as of August 8th (00:00 UTC).

-

DCR, ENJ and FTT saw the greatest increase in social volume over the past 30 days.

-

Social mentions for Lido’s LDO token have also increased ahead of Ethereum’s Merge.

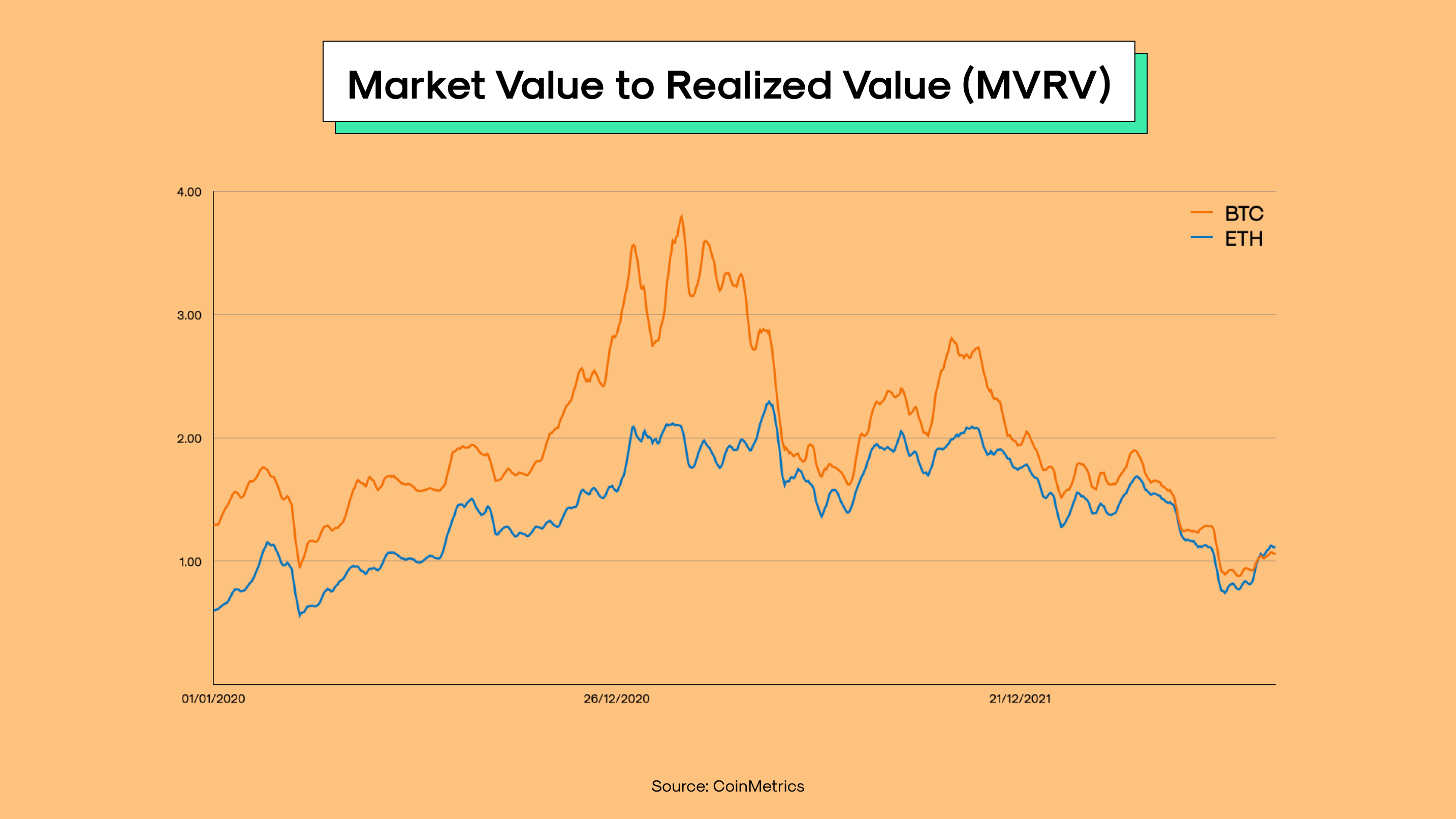

The Market Value to Realized Value (MVRV) for BTC and ETH continue to move higher after bottoming in June. The MVRV is calculated by dividing market capitalization by realized capitalization. A value below 1 has historically indicated bottoms for BTC and ETH. Therefore, the on-chain indicator suggests the worst of the downturn could be over, given that the MVRV rose back above 1 on July 18th and has been trending higher since then.

The Merge is Looming

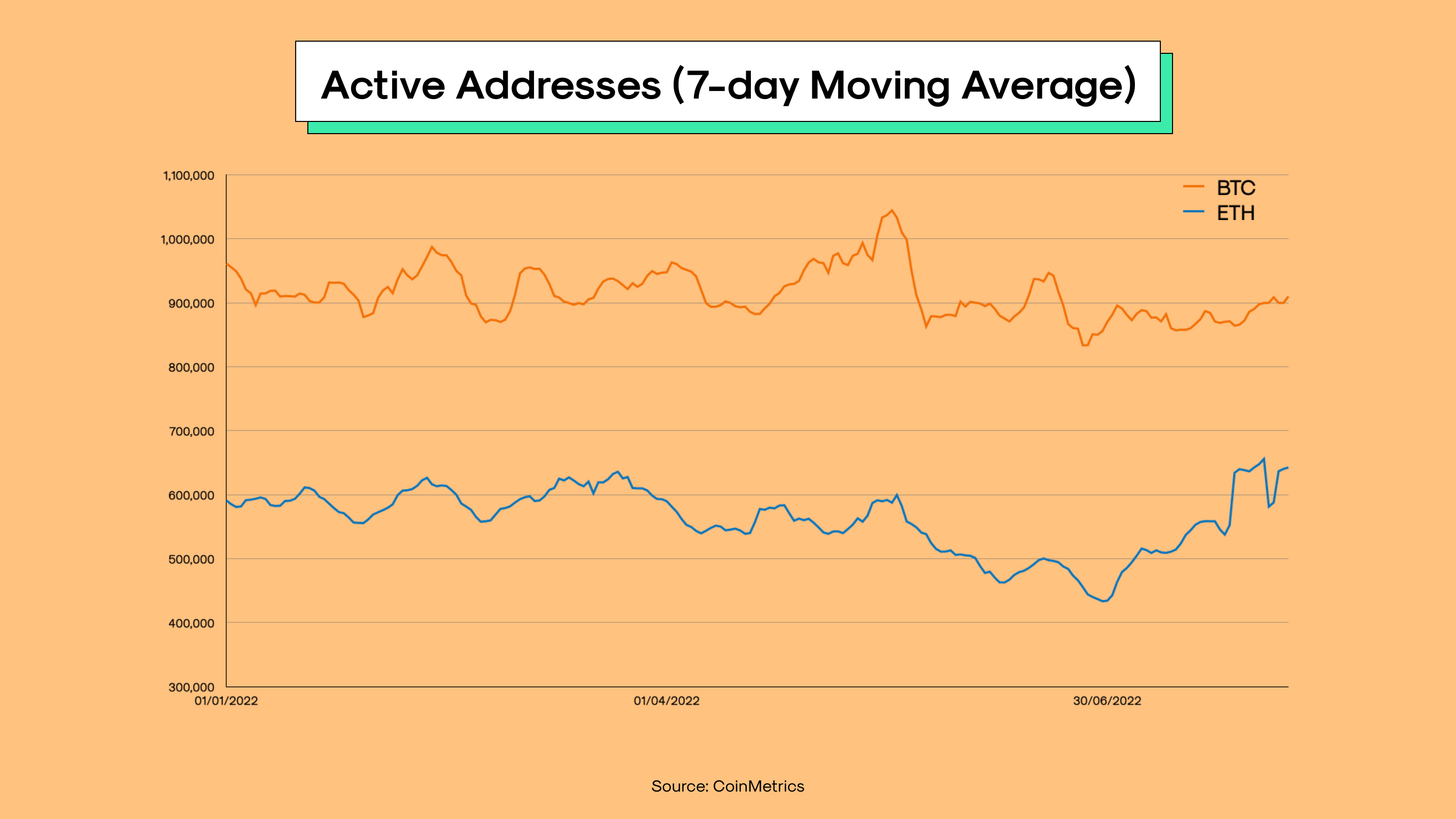

The Merge is looming! On July 16th, a provisional date for the highly anticipated upgrade was penciled in for mid-September, sparking bullish sentiment in the cryptocurrency market over the past few weeks. While active addresses have remained relatively flat for BTC, the same metric has seen a large uptick during July for ETH, suggesting daily activity on the Ethereum blockchain is rising.

Read our explainer of the Merge here.

The Goerli testnet will be the last practice run before the shift to a Proof-of-Stake consensus on Ethereum’s mainnet and is due in the next couple of days on August 10th, once the Goerli testnet hits a total difficulty of 10,790,000. During the upcoming week, the Merge schedule will be set in stone at the Merge community call.

There’s also talk about a hard fork to continue Ethereum as a Proof-of-Work chain, but it’s unclear if there will even be a robust ecosystem formed around this new token. With the shift to Proof-of-Stake, Ethereum miners will have to redirect their hash power elsewhere and their mining machines will become obsolete for the main Ethereum chain once the upgrade is complete. As a result, Proof-of-Work assets like ETC and RVN (which could potentially harbor miners exiting from Ethereum) are experiencing an increase in both price and trading volume.

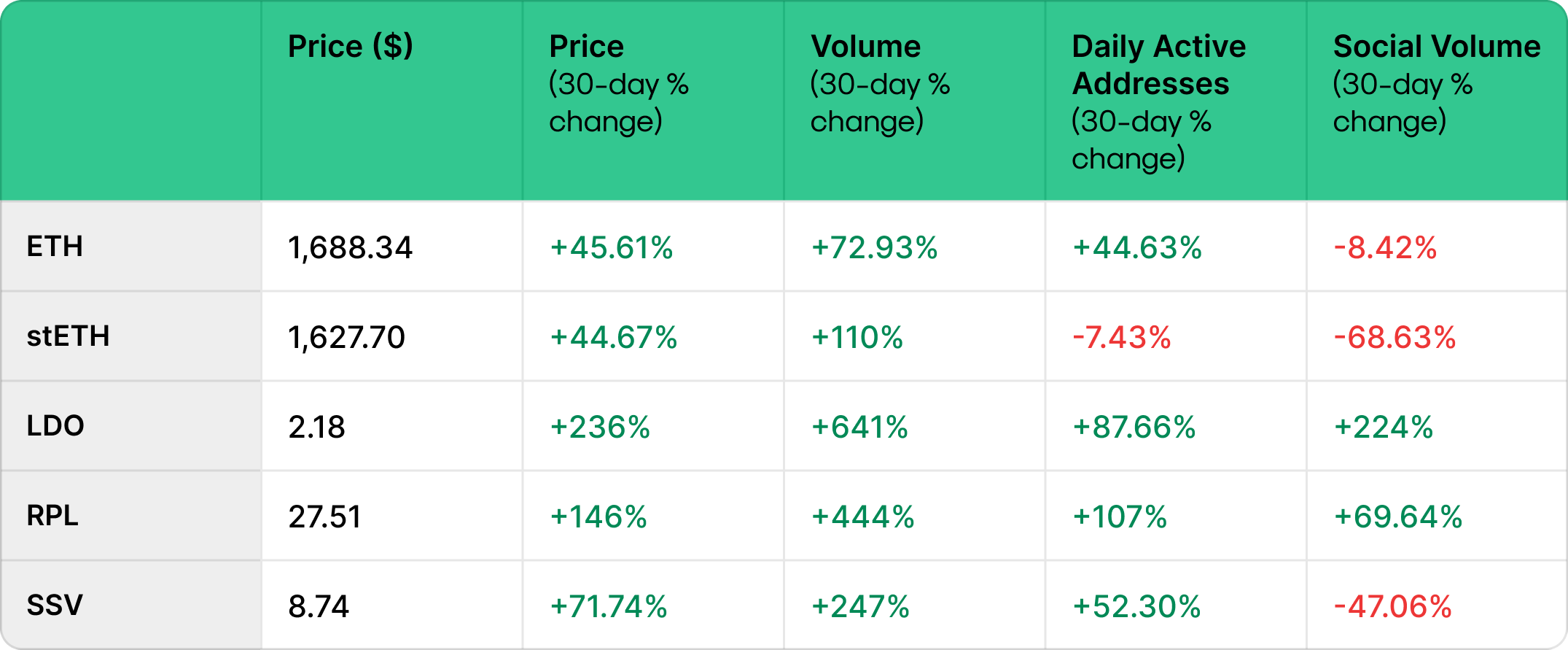

Other crypto-assets that have seen upswings since the provisional date for the Merge was announced include ETH, as well as tokens related to liquid staking (LDO, RPL) and staking infrastructure (SSV). Below we detail a snapshot of these assets that have so far benefited from the ‘Merge trade’.

Source: Santiment; https://app.santiment.net/s/cSDzOMxQ, as of August 9th (14:00 UTC).

ETH

An obvious Merge play: buy ETH or use derivatives to get long exposure.

The most important upgrade for the second largest blockchain network by market capitalization has already boosted the price of ETH. However, the Merge could well be a ‘buy the rumor, sell the news’ situation. Nevertheless, a successful execution should see the bullish momentum continue.

Go long (or short) on ETH-USD with up to 10x leverage here.

stETH

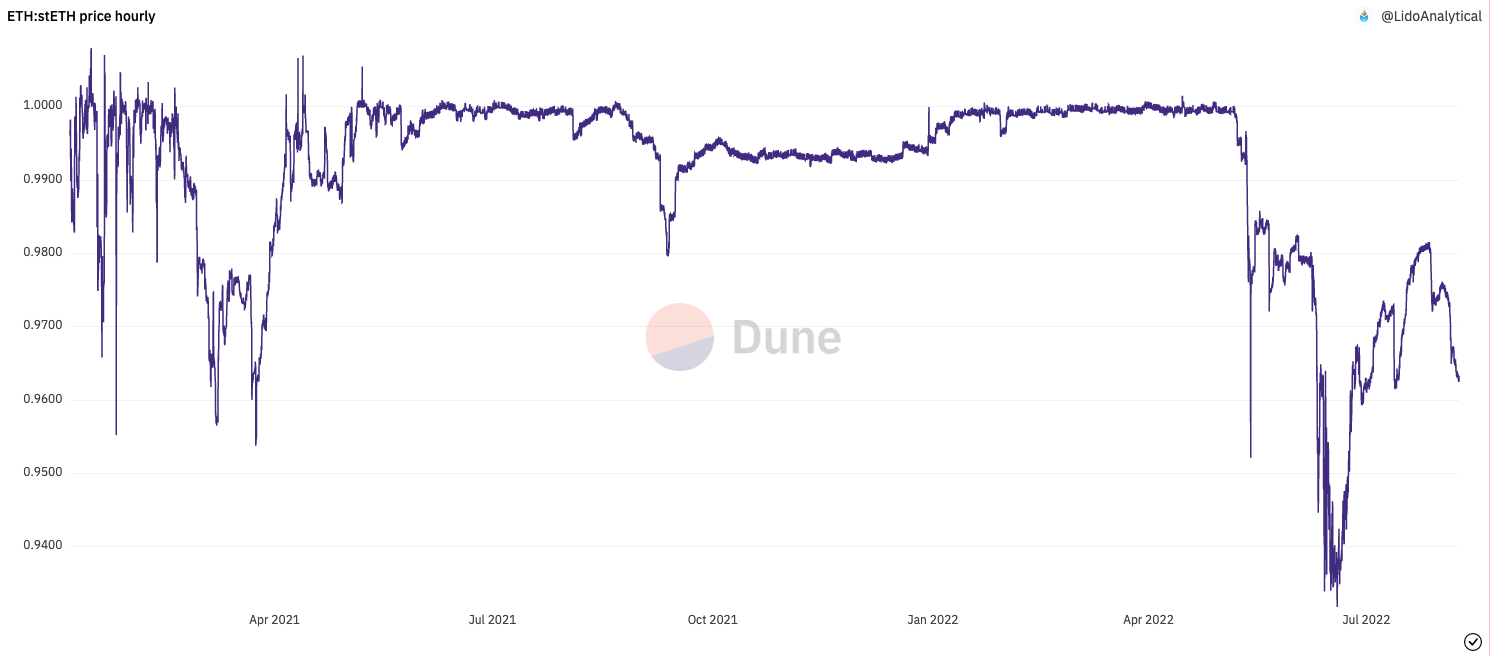

Another option is to purchase Lido’s liquid staking derivative, stETH, which is currently trading at a discount. Since the deleveraging event in June 2022, stETH has slowly started to return to parity with ETH, currently trading around 0.96 ETH.

Source: <https://dune.com/queries/96886/194200 \](https://dune.com/queries/96886/194200)

Lido is currently the leading decentralized liquid staking provider and also the first to market, allowing anyone to earn a yield on their ETH by converting it to their liquid staking derivative, stETH. This token represents the value of the ETH deposit and the staking rewards earned, which is integrated into many DeFi protocols

Until beacon chain withdrawals are enabled (expected to be sometime in the 12 months following the Merge), stETH may still trade at a discount to ETH. But if you have a long time horizon and are bullish on Ethereum, then it may be worth accumulating stETH at current prices as it will be redeemable one-to-one with ETH once withdrawals are enabled.

LDO

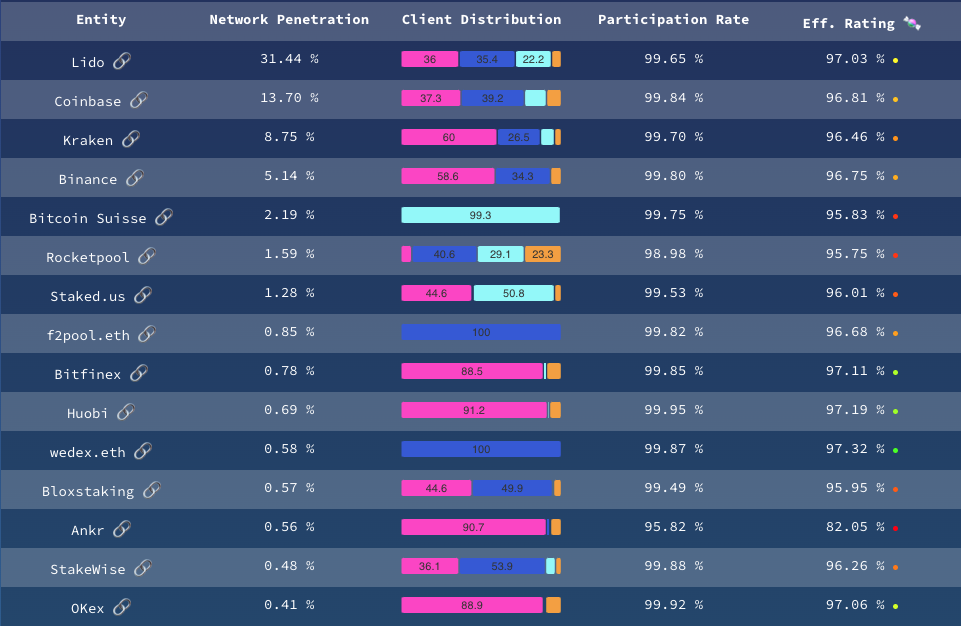

Another crypto-asset that is set to benefit from a smooth and successful Merge is Lido’s LDO token. Lido has secured the majority of beacon chain deposits, much higher than even Coinbase and other popular centralized exchanges.

Source: <https://www.rated.network/ \](https://www.rated.network/)

The LDO token is used for governance to grant voting rights in the Lido DAO, which decides on key parameters like the fees and protocol upgrades. Locking more LDO in the voting contract, the greater the user’s decision-making power.

But the token doesn’t currently have any value capture mechanism at this point in time and has a very low percentage of its supply in circulation. Nevertheless, LDO has seen a bullish surge in the past few weeks as confidence in the Ethereum ecosystem improves, which could likely continue into September, especially given Lido is by far the leading liquid staking solution.

RPL

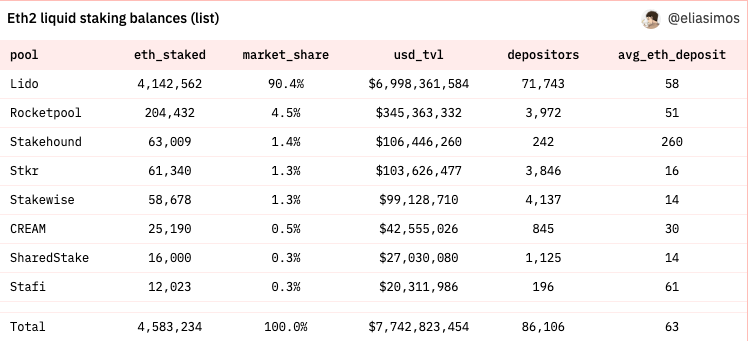

Rocketpool’s focus since 2016 has been squarely set on providing a decentralized staking pool system by lowering the barriers to entry: the hardware requirements and of course, 32 ETH (currently worth over $50,000).

What Rocketpool does is to enable anyone to become a validator with just 16 ETH, instead of the usual 32 ETH. Node operators can create mini-pools just by putting up half of the required 32 ETH, with Rocketpool providing the rest. To increase decentralization and security of the Ethereum network even further, there are plans for mini-pools with lower collateral requirements of 4 ETH.

Other Ethereum users with any balance can stake with a node operator in a non-custodial way to receive rETH, a liquid staking derivative similar to stETH. Node operators earn returns from their staking and commissions; they also receive rewards in another token, known as RPL.

If Rocketpool manages to obtain a higher share of the staking market, the RPL token should accrue value long-term. As more deposits and more ETH is staked with Rocketpool, more RPL will be locked up since node operators are required to have 10% of their ETH stake in the token as insurance to participate on the network.

Source: <https://dune.com/ratedw3b/Eth2-Liquid-Staking \](https://dune.com/ratedw3b/Eth2-Liquid-Staking)

To learn more about the bullish thesis for RPL, check out this Twitter Space.

SSV

SSV is ssv.network’s native token, a play on staking infrastructure that has outperformed ETH in recent weeks. Along with an 71.74% increase in the price, SSV has recently experienced strong growth in both active addresses and trading volume.

As a fully decentralized, open-source ETH staking network based on Secret Shared Validator technology, ssv.network provides an open infrastructure for splitting and distributing a validator key into multiple KeyShares. The splitting of the validator key allows an Ethereum validator to run across multiple non-trusting nodes in order to avoid slashing (a penalty applies to a portion of their ETH staked for not being online).

The SSV token’s purpose is twofold: to confer voting rights for governance and as a currency to pay operators their fees to maintain validators that generate ETH rewards for stakers. The more ETH that is staked in the network, the more fees will accrue to operators and the DAO treasury.

FXS

The decentralized stablecoin project Frax has also entered the fray, introducing its own liquid staking derivative and the native FXS token could also benefit from the Merge if its recently released staking derivative frxETH gains traction. The beacon nodes are already live, and once Fraxlend launches, it will be possible to borrow against the frxETH staked derivative. While frxETH is still in development, it could potentially be a bullish catalyst for FXS as we approach the activation of the Merge.

Upcoming Events

-

August 10: US Consumer Price Index (12:30 UTC): if the CPI reading comes in below the estimate of 6.1% (YoY), then this may benefit risk assets.

-

August 10: The Goerli/Prater Merge for Ethereum is expected on August 10th, once Goerlin hits a total difficulty of 10,790,000.

-

August 12: Merge community call (14:00 UTC)

-

August 14: CRV emissions reduced by 15%

-

August 17: What’s New in Eth2 call (14:00 UTC)

-

August 17: FOMC minutes (18:00 UTC): the minutes from July’s Fed meeting will be published, traders will be looking for guidance on the next interest rate decision on September 21.

-

August 25: US Gross Domestic Product Annualized Q2 (12:30 UTC): growth reading will be taken into account for the Fed interest rate decision in September.

-

August 25-27: Jackson Hole Symposium: annual meeting between central bankers, finance ministers and academics, focusing on an important economic issue that faces world economies.

We want to hear your feedback and also hear what future topics you’d like to see in our monthly report. Contact us via Discord or Twitter using the links below.**

**

Disclaimer: the contents of this report should not be taken as financial advice and is provided purely as market commentary. The information provided in this report is not intended to form the basis for making investment decisions and is presented here for educational purposes only. Please do your own research before participating in the crypto market, seek independent advice on crypto-assets and ensure you are aware of the risks involved.