Bonjour frens!

Several Perp team members were present in Paris for the 5th annual Ethereum Community Conference.

We met up with other teams BUIDLing in DeFi and co-hosted the DAIvinity party, where our French Pepe T-shirt was quickly snapped up (which will soon become available on the Perp merch store!).

Also, our team members attended a lot of interesting talks, some of which recapped below!

Overview

- Day 1

- The Soul of a New Machine: Next-Generation Optimistic Rollups with Cannon

- Crypto Adoption, Social Media and Influencers

- Designs for Inflation Resistant Stablecoins

- Day 2

- About the Benefits of Harnessing DeFi Data in Inefficient Markets

- Entering the Era of Web3 Social

- Day 3

- Blockchains: A Data Scientist’s Dream

- Vitalik Buterin On the Future of Ethereum

Day 1

The Soul of a New Machine: Next-Generation Optimistic Rollups with Cannon

Check out the full talk here👉 https://www.youtube.com/watch?v=2RjkkoGUTx0

If you want an introduction to optimistic rollups, then you don’t want to miss out on the talk by Norswap from the Optimism team, who delivers a short introduction as part of his talk on Cannon.

With optimistic rollups, a challenge game is basically being played between verifiers and defenders on Ethereum’s layer 1 to prove block execution. A challenger can always contest faulty output roots as long as the layer 1 is secure, preventing any fraudulent withdrawals to the Ethereum main chain.

In this talk, Norswap gives us a detailed walkthrough of Cannon, the fault proof or challenge game system that secures Optimism and is also the first that supports EVM equivalence, so that it is compatible with whatever is already built on Ethereum.

The next version of the system will be Bedrock, which was covered in a workshop by Liam Horne and Joshua Gutow, which can be replayed here.

Crypto Adoption, Social Media, and Influencers

Replay link ⏪🔗: <https://www.youtube.com/watch?v=3o58fKwwCkk ](https://www.youtube.com/watch?v=3o58fKwwCkk)

Sacha Ghebali from The TIE, an institutional crypto data provider, shed some light on whether you can trade on the sentiment of Twitter chatter and sentiment scores.

Appealing to the data to answer whether you make money trading on sentiment was the one focus of the talk. The chart below shows the cumulative return of four sentiment trading strategies when trading the top 100 coins by sentiment score, as well as their respective Sharpe ratios (a measure of risk-adjusted returns). The blue line shows the returns for holding the top 100 assets by sentiment score, which has an unfavorable Sharpe ratio of less than one.

But what if you went long on the top quintile (i.e., the top 20) coins, shorted the bottom quintile according to the sentiment score and re-balanced each day, instead of just the top 100? As the red line on the chart above shows, this would have vastly outperformed the simple ‘hold top 100’, with a return of ~10x since 2021 and has a respectable Sharpe ratio of 3.7.

Improving on this even further would be a strategy where you’d do the following: long the top quintile by sentiment and short bottom quintile, as well as longing the top 100 and shorting the bottom quintile. The backtested results for this alternative strategy gives a Sharpe ratio of 3.8.

Although it’s important to remember that past data is no indication of the future, Sacha stressed it wasn’t financial advice and that these results do not consider the cost of funding these positions, trading fees to rebalance or market impact. Nevertheless, it shows that sentiment data is an interesting and useful tool for trading insights.

Designs for Inflation Resistant Stablecoins

Watch the full talk by Pablo Veyrat who works on the Angle Protocol, the issuer of the euro focused stablecoin agEUR 👉 <https://www.youtube.com/watch?v=gvWCYL73b64 ](https://www.youtube.com/watch?v=gvWCYL73b64)

Any stablecoin, whether it’s USD or EUR based, suffers from the same problem as fiat: the purchasing power decreases over time. Products that are insulated from inflation already exist in centralized finance, for example Treasury Inflation-Protected securities (TIPS), so how could one be built for DeFi?

In this talk, Pablo explained the possibilities and challenges of building a decentralized, inflation-resistant stablecoin. Essentially, two components are needed: an oracle and a backing mechanism. While inflation is traditionally measured by the Consumer Price Index (or CPI), it’s only published once every month, is prone to manipulation and the index methodology often changes over time and across different countries.

An alternative approach is to build an oracle tracking something like the TIPS, which are exchangeable in the markets and have a price. Then the price can be compared with the non-inflation protected security for the same asset to create an index that estimates inflation in real-time.

For the backing mechanism, there are three main categories for decentralized stablecoins:

- Seigniorage share: like UST (which Pablo rules out due to death spirals).

- Hedge-fund model: which is already implemented by inflation resistant stablecoins like FRAX’s FPI and VOLT. These work a bit like hedge funds, where USDC is invested in yield strategies to realize a return that’s higher than inflation and a fallback mechanism in case the yield does not outweigh inflation.

- Borrowing model: Examples include Angle’s agEUR (which is due to launch on Optimism soon), Maker’s DAI, and Aave’s GHO. It’s something that can work, but with a debt-based mechanism, there are questions around the incentives to borrow inflation resistant assets.

An inflation-resistant stablecoin is an ambitious task, but a mix of both the borrowing and hedge fund models may provide a solution, and there are already some protocols actively working on the tools to make launching an inflation-resistant stablecoin a reality.

For example, Pablo noted that MakerDAO is thinking about this problem and is working with Backed Finance to acquire inflation-protected securities, like buying US debt, which can then be used to back DAI and the yield can pay off DAI holders and ensure inflation protection.

Day 2

About the Benefits of Harnessing DeFi Data in Inefficient Markets

Kaiko’s Anastasia Melachrinos delivered a great talk on harnessing DeFi data, highlighting the importance of monitoring DEX data to find an edge by using the collapse of Terra and UST as a case study.

Replay link ⏪🔗: <https://www.youtube.com/watch?v=s0l1cbWWCb4 ](https://www.youtube.com/watch?v=s0l1cbWWCb4)

A few of the interesting observations from the presentation:

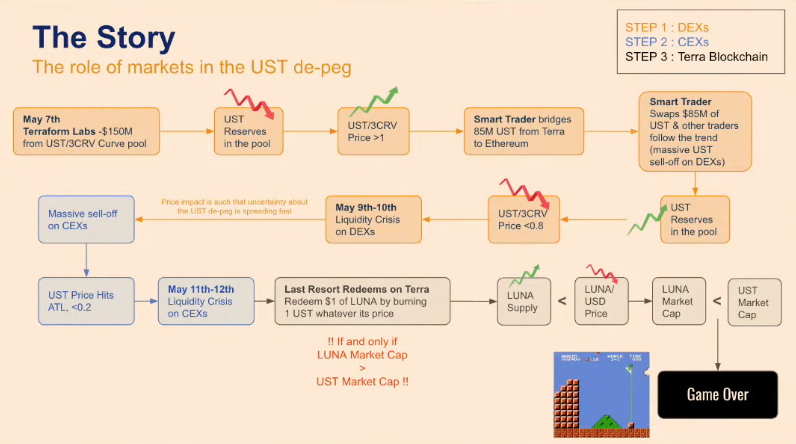

- The liquidity crisis in UST happened on decentralized exchanges (DEXes) several days before it occurred on centralized exchanges (CEXes), with early imbalances in Curve’s UST-3CRV pool and massive sell pressure on DEXes signaling the de-peg event.

- The slide below highlights the importance of monitoring the relevant on-chain data, as it would have allowed to catch on several days before traders that don’t track on-chain events or who are purely focused on CEXes.

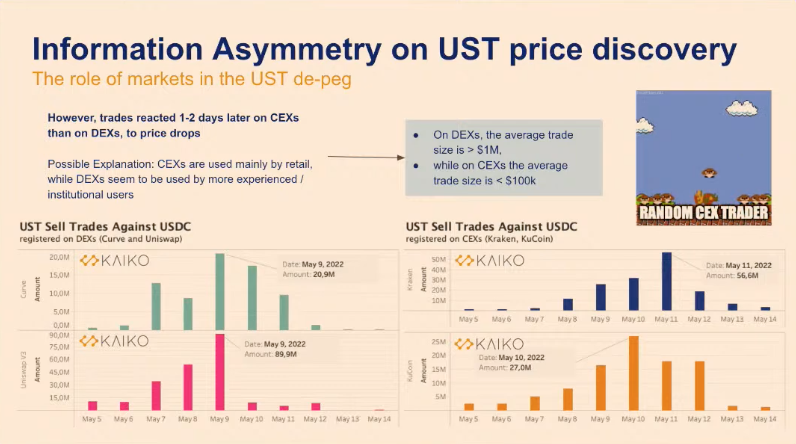

- By looking at the data, the information asymmetry between traders on DEXes and CEXes is apparent: the peak in UST sell trades for USDC on DEXes was on May 9th, 2022. However, for centralized venues, UST sell trades against USDC peaked much later: on May 10th for KuCoin and May 11th for Kraken, suggesting that the information asymmetry is significant between traders on CEXes versus traders on DEXes.

Monitoring blockchain data can help traders to anticipate certain events in advance and, in Anastasia’s own words, you’re taking additional risk by ignoring what’s really happening on-chain:

***“Not having access to DEX data is taking unconsidered risks”. ***

Check out our Dune Analytics starter guide to get to grips with on-chain data analytics, as well as some course recommendations to go even further.

Entering the Era of Web3 Social

Watch the full video to learn more about how Lens is revolutionizing the creator economy and social media 👉 <https://www.youtube.com/watch?v=S0vHllZEACc ](https://www.youtube.com/watch?v=S0vHllZEACc)

Aave founder Stani Kulechov gave a talk on the Lens Protocol, a social platform built on smart contracts and inspired by Vitalik Buterin’s EthCC[4] talk about the need for non-DeFi applications on Ethereum.

Bitcoin, Ethereum and NFTs have become assets in their own right and Stani thinks we’re starting to see the same process for social content, like memes, telling the audience,

***“Curators are a creator class that is at the moment quite undervalued”. ***

Lens is all about thinking about how to bring this issue to the forefront and make it more rewarding to be a digital curator, while also ensuring that you can’t get ‘de-platformed’.

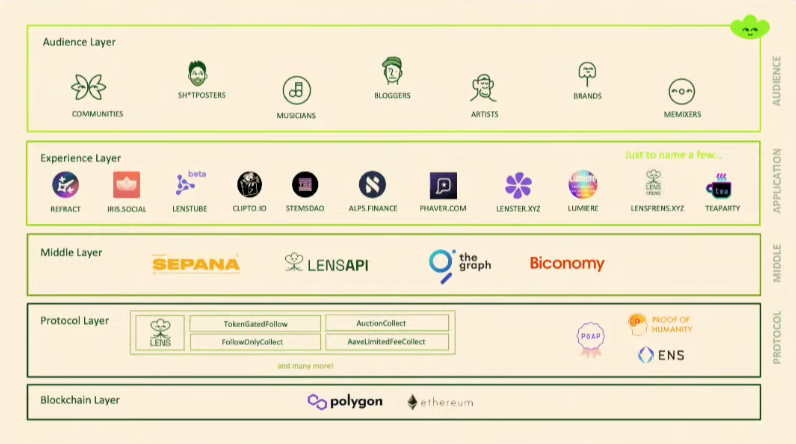

One key piece to enable this new social landscape is the NFT infrastructure of Lens: profile NFTs, follow NFTs to enable censorship resistant communication channels, and every post is… yep, an NFT, opening up different kinds of monetization strategies for curators.

Stani explained that audiences in the Lens ecosystem can access the same content through multiple front-ends in the experience layer. Some examples of popular applications in the experience layer include Lenster, LensTube and ORB (Web3 alternatives to Twitter, YouTube and LinkedIn respectively).

Have you joined the Lensverse yet? Follow us at https://lenster.xyz/u/perpetual.lens!

Day 3

Blockchains: A Data Scientist’s Dream

Replay link ⏪🔗: <https://www.youtube.com/watch?v=d2kzuzLmfEU ](https://www.youtube.com/watch?v=d2kzuzLmfEU)

Elizabeth Yeung and Daniel Khoo from Nansen.ai presented on how to hone in on blockchain data to inform your investment decisions.

On-chain data is a proven source of alpha for crypto investors, but navigating this data can be difficult as Elizabeth explained,

“Alpha lies in revealing patterns that are not apparent from the raw data, so we need to know what we are looking for and how to look for it.”

Wallets are unknown when working with the raw on-chain data, so part of what Nansen does is to create labels (with over 120 million labeled so far!) to give more context to wallet addresses, such as behavioral labels like ‘DEX trader’.

The presentation also went over the hot contracts feature to show you what’s going on in Ethereum blockchain, telling you where activity is highest, smart money feature to show what institutions and those who have been profitable on DEXes to see what they’re doing. Finally, Daniel also showed what’s possible with Nansen, providing insight into stETH de-pegging event.

Vitalik Buterin On the Future of Ethereum

Vitalik Buterin gave attendees insights into the longer-term vision for Ethereum 👉 <https://www.youtube.com/watch?v=kGjFTzRTH3Q ](https://www.youtube.com/watch?v=kGjFTzRTH3Q)

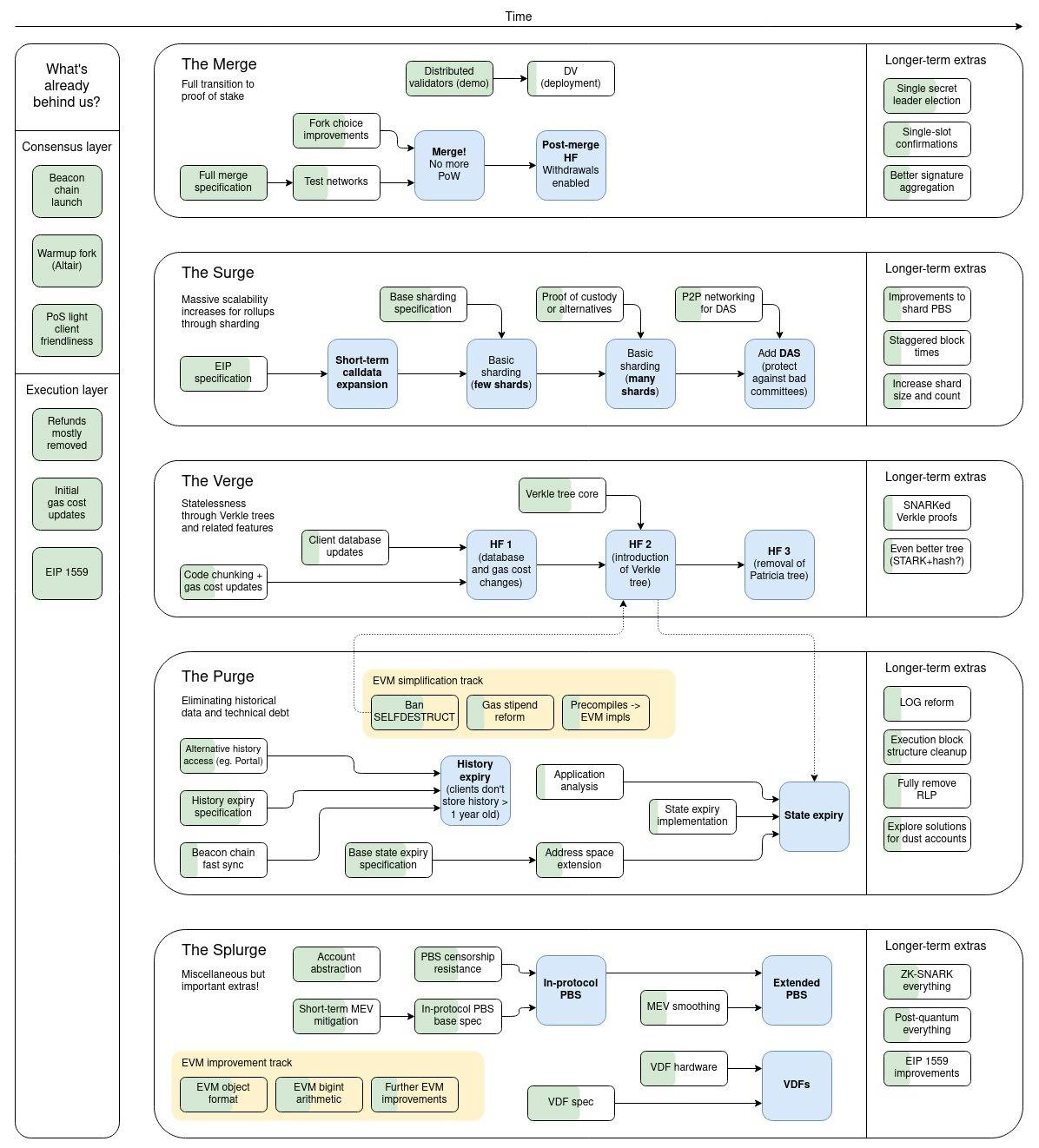

Vitalik opened with a recap of the current Ethereum roadmap, including the Merge (transition to Proof of Stake), the Surge (sharding), and the Verge (which introduces Verkle trees) and broke down all of these phases in the diagram below. With rollups and sharding, Ethereum will be far more scalable and, according to the math, will be close to 100,000 transactions per second.

“Ethereum will be 55% complete after the Merge”

But completion of the Merge will involve deep changes, where the switch to Proof of Stake will decrease emissions from five million ETH per year to a formula that is a function of the amount of ETH that’s being staked. The security model and transaction inclusion process will also be transformed.

Buterin said Ethereum finds itself in the midst of a period of rapid change in an effort to dramatically increase the capability of the system, but it doesn’t need to last forever. The complexity of the system needs to increase to accommodate changes such as EVM improvements, but this complexity will eventually settle down and eventually decrease over time.

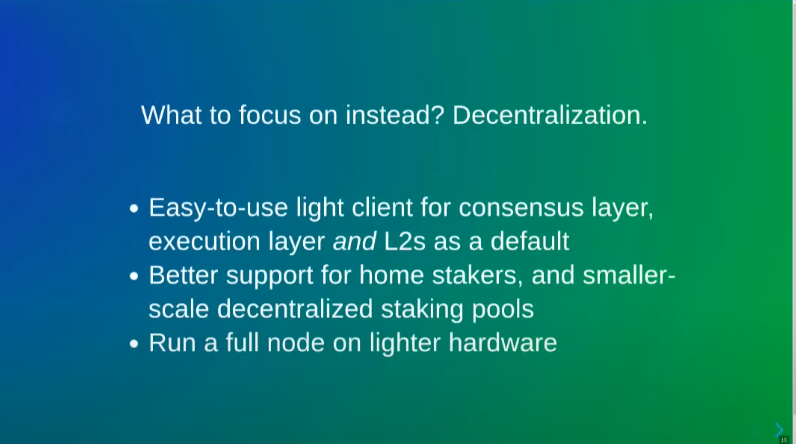

The talk also included short-term pain, long-term gain opportunities, changes worth making in the long-term, what he’s scared of doing regarding Ethereum’s development and emphasized the focus on decentralization, saying,

“I personally still want mobile phone staking to be eventually possible…”

Au Revoir! See You at EthCC[6]

There were dozens of other great talks covering a range of topics such as DeFi, developer tools, governance, NFTs, privacy and security, all of which are listed on EthCC[5]’s full agenda.

The videos from each talk can be replayed on the following YouTube channels, depending on which stage it took place:

- Grand Amphi Théatre (Main Stage & Bievre talks)

- Amphi Monge

- Amphi St Germain

- Amphi Pontoise

- Amphi Sorbonne

Thanks to all the organizers, speakers and sponsors for putting on such a fantastic conference! See you at EthCC[6] next year! 👋 🇫🇷