Perpetual swaps allow traders to profit from both uptrends and downtrends. In this article, we’ll go over some ways you can use perpetual swaps to make money in bearish markets.

A bear market is usually defined as a widespread decline in asset valuations of at least 20% from the highs. Despite declining prices, that doesn’t mean you cannot profit from when the market is in ‘down only’ mode.

First off, it’s important to remember that you can go short as well as go long to profit using perpetual swap contracts.

1. Shorting with Perpetual Swaps

When you are going short on Perp v2, what you are effectively doing is getting the clearinghouse to issue you vTokens that you want to short (e.g., vETH for the ETH-USD market). These tokens are then swapped for vUSD in the Uniswap v3 pool.

As the price of ETH falls, the amount of vUSD required to pay back the initial vETH debt declines, meaning you end up with a positive profit once you close the trade and convert the vUSD tokens back into vETH.

Example

You want to go short on ETH at $1,300 and use your collateral to open a short position of 1 ETH. The clearinghouse will issue 1 vETH token and then sell for 1,300 vUSD in the Uniswap v3 pool.

Now, if the price of ETH falls by $300, you only need to pay back the debt corresponding to 1 vETH token, which will now be 1,000 vUSD. The remaining 300 vUSD will count as your profit and is added to your total collateral once the short position is closed.

You can also use limit orders to short perpetual swap contracts at a price higher than the market price and take advantage of bear market rallies.

During bear markets, rallies are often observed but can be short-lived. Therefore, limit orders can be utilized to catch these moves and automatically enter short positions at key resistance levels to profit from plummeting crypto prices.

2. Easy LP: Bearish Mode

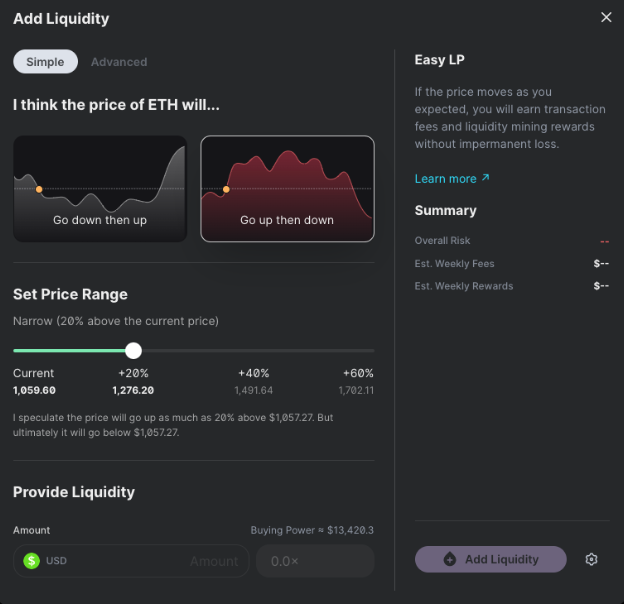

While you can go short as a taker, another way to profit in bear markets is to become a maker by using the Easy LP’s bearish mode.

The Easy LP feature allows you to express market views, both bullish and bearish, and during a bear market, traders can select the bearish mode to provide liquidity to earn trading fees while minimizing impermanent loss.

The mechanics of Easy LP are explained in more detail in this article. As a refresher, the bearish mode places liquidity to the upside in the base token (e.g., vETH for the ETH-USD market). Essentially, what this mode does is sell ETH into any upward movements and converts ETH into USD.

As the price goes higher, your allocation of tokens will shift from ETH to USD. However, since you’ve selected the bearish option, as the price falls and returns to your entry price, you’ll be scaling back into ETH. And when the price approaches the entry price of your liquidity position, your impermanent loss will trend towards zero.

In short, the bearish mode for Easy LP allows traders to earn a return from their liquidity while at the same time, minimizing impermanent loss when markets go up and then down.

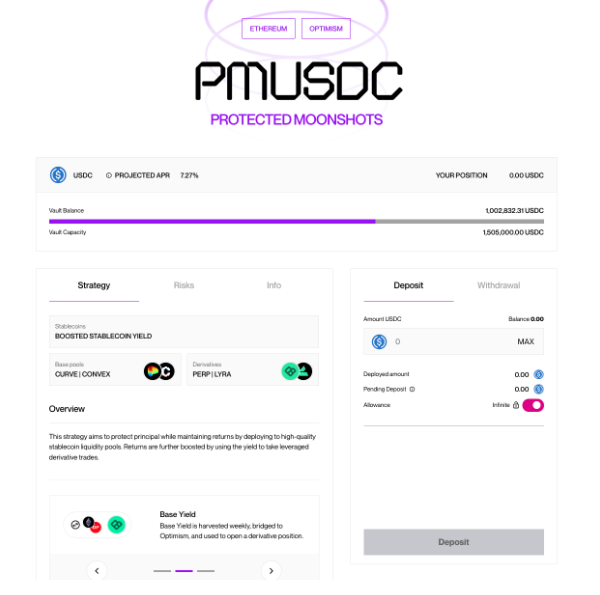

3. Brahma’s PMUSDC Vault

For a passive investing strategy, traders can make use of Brahma.fi’s Protected Moonshot vault.

The vault takes USDC in as deposits, deploys them to stablecoin liquidity pools on Curve Finance, stakes the LP tokens into Convex Finance and then uses the yield earned to open perpetual swap trades on Perp v2 and options trades on Lyra. The profits from these derivatives trades are then compounded back into the strategy.

The trades taken on Perp v2 are a systematic momentum strategy that profits off the price movements of ETH-USD, whether the market is bearish or bullish. A trend-scanning algorithm is utilized to ensure that the directional trading generates a consistent return for the vault.

With a projected APR of 6.76% at the time of writing, using Brahma’s vault offers a convenient way to earn profits in a bear market.

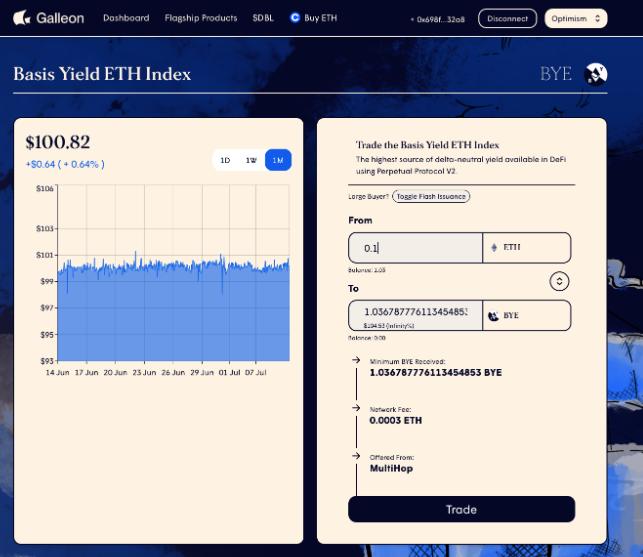

4. Basis Trading

Several of our partners have implemented basis trading strategies to capture funding payments and provide a delta-neutral yield for investors.

A few examples include IndexCoop’s Market Neutral Yield ETH ($MNYe), GalleonDAO’s Basis Yield ETH Index ($BYE) and Diamond Protocol’s ETH Cash & Carry vault. The benefit of using these basis trading vaults is that no matter what direction the market is heading, depositors can earn a return from the funding payments captured by these vaults (provided the funding rate for ETH remains positive).

In essence, these vaults work by going short on ETH-USD via Perpetual Protocol to earn funding payments when the funding rate is positive and then taking an opposite position of the same size on Uniswap v3. What this does is provide a delta-neutral yield, so even if the market continues to be bearish, you can earn a yield by purchasing the $BYE token or by depositing into the Cash & Carry vault.

Check out the full list of structured products built on top of Perpetual Protocol here.

5. Create a Synthetic Dollar Position

While the last strategy is not strictly a profit-generating technique, it can be an effective way of locking in gains. For example, you can lock in the USD value of your crypto-asset portfolio by using perpetual swaps to create what’s known as a synthetic dollar position.

Let’s say you own 0.10 BTC, 0.50 ETH and some stablecoins. To mitigate drawdown in USD terms for this crypto portfolio, perpetual swaps make it possible to lock in the current value of your portfolio by shorting both BTC and ETH. Let’s say the price of BTC is $20,000 and the price of ETH is $1,200. The total USD value of your crypto portfolio is $2,600.

You can use $1,300 worth of USDC as collateral to open two short positions with 2x leverage: one position for 0.10 BTC and another for 0.50 ETH. Then, when the prices of these assets fall, you’ll make money on the active short positions and these profits cancel out any unrealized losses on the crypto-assets held in your portfolio.

For example, you go short when the price of BTC is $20,000 and the price of ETH is $1,200 and the prices fall to $15,000 and $800 respectively, you’ll have profited around $500 on the 0.10 BTC short and $200 on the 0.50 ETH short, which counteracts the loss of value from your holdings of 0.10 BTC and 0.50 ETH.

Using perpetual contracts in this way is known as creating a ‘synthetic dollar’ position, since by opening these shorts, you are effectively locking in the USD value of your portfolio without converting your assets to fiat currency.

Summary

So there you have 5 ways to profit using perpetual contracts when the market is bearish!

Traders can use perpetual swaps to go short and profit from downward trends. The Easy LP’s bearish mode allows liquidity providers to express bearish market views by placing liquidity entirely to the upside in the base token and earn trading fees in the form of USDC.

Several options to profit from the bear market also exist via our partners, e.g., through Brahma’s protected moonshot vaults and basis trading offerings. Finally, a synthetic USD position can be constructed using perpetuals to hedge your existing crypto holdings, ensuring that it insulates the USD value of your portfolio from downward movements in the market.